|

The National Provincial Bank 1960 B.C. – (Before Computers)

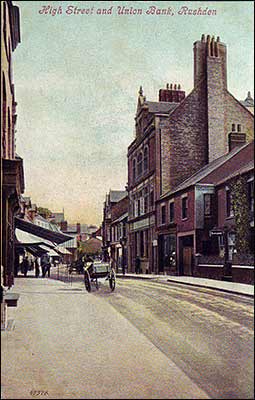

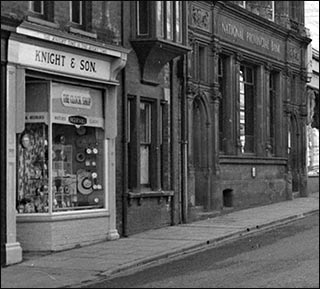

The tall, beautifully carved and decorated frontage of this grand building in Rushden High Street, built originally for the Northamptonshire Union Bank in 1889, gives the impression of timeless solidarity and unchanging tradition, and until the introduction of computer technology in the late 1960’s this also applied to the appearance and procedures inside the building.

The customers entered the bank through the heavily carved wooden door on the right of the building, the matching left hand door at that time leading to the Manager’s flat above. The brick house to the left was occupied by the Accountant (assistant manager) and his family and the large archway at the side led to their back door and garden. The wooden gate across this entrance with its small inset door has only recently been removed.

Inside, the customers entered a traditional banking hall with a high ceiling of ornate plasterwork, a polished wooden floor and a wide mahogany counter stretching the length of the office. There were no barriers between them and the cashiers and the workings of the branch went on in full view of the general public. There were usually two or three cashiers on duty, depending on how busy the day was: Thursdays and Fridays, being wages days, meant a great deal of preparation before the bank opened at ten o’clock, as all the cash had to be counted by hand and bagged or banded up. All the factory workers’ wages were paid in cash, and as the National Provincial held the accounts of most of the large shoe factories and the subsidiary companies which supplied and supported them, money for the thousands of pay packets had to be issued by the bank for their wages clerks to distribute at the end of each week.

Behind the counter ran a high bench, pitted and scarred by many years of use, also running the length of the banking hall, with a sloping desk top and several knee holes separated by deep shelves, very reminiscent of those described in Charles Dicken’s novels. The ledger clerks (mostly girls) sat here on tall, backless wooden stools, entering the day’s transactions into heavy ledgers, some 50 x 40 x 10cm in size. Each desk still had its inkwell, and if anyone was foolish enough to forget to bring her fountain pen to work, all the entries had to be made with a dip-in pen and then blotted before turning the page. (Ballpoint pens were not allowed as the writing faded with age.) Each ledger held the records of the current accounts of both private and commercial customers, with a separate ledger for the savings, or deposit, accounts. Banks did not offer the many and varied types of savings facilities from which present day customers make their choice, so very little ‘shopping around’ for the best returns took place and the bank clerk’s life was correspondingly a lot easier. Each page was headed up with the customer’s name and address in large and (ideally) very neat handwriting. If the customer was overdrawn the interest was worked out as each transaction was entered and when the page was full every column had to be added up without the aid of calculators or adding machines and the total carried forward. Bearing in mind that these were the days of pounds, shillings and pence, the clerk had to quickly learn to speed up her mental arithmetic in order to keep up with the work. The Accountant very impressively was able to add up all three columns at the same time, three fingers slowly descending the page, while everyone else had to add up each column separately.

At the back of the office were several individual desks for the other clerks, senior clerks and the Accountant, and a little apart from the others, the Manager’s typist. A kiosk containing one of the only two available telephones stood in the corner. Very few personal calls were made and even fewer received. The Manager’s office was at the end farthest from the main door next to another room used for private interviews. Most of the main filing was done in a tiny room downstairs and archived in the strongroom together with the cash and customers’ safe deposit boxes.

All the old ledgers dating from when the bank first opened were kept in the vaults below and were an impressive sight. The writing was in immaculate copperplate handwriting with very few miscalculations or crossings-out, all done with dip-in nib pens with painstaking neatness and as clear and bright as if written yesterday. What a history of Rushden they contained, recording the rise in fortune of a boom town and its community, the successes and failures of new enterprises at a time of rapid growth both of industry and population, the ebbs and flows of personal fortunes, the accounts of shoe masters and their families and the ordinary trades people and shopkeepers of the town, some of whose names are still in evidence today.

The pride and joy of Rushden’s National Provincial Bank at this time was an N.C.R cash machine which printed out customers’ statements and each day’s transactions, as well as all the summaries and cash reports for each banking period. Its speed depended almost entirely on the skill of the young lady operating it, and some clerks could work up a tremendous pace, with flying fingers accompanied by wonderful sounds of keys clicking, the carriage banging back and forth, its bell ringing, and a grand crescendo of several whirrs followed by a crash as it printed the total. An experienced machine operator was an impressive sight. All this had to be done with total accuracy, as every new statement heading had to be typed out, as had every cheque’s payee, cheque numbers not being used until several years later. Should an amount be entered in error, or in the wrong column, the whole statement had to be re-typed, especially annoying if it was near the end of the sheet. At the end of the day the statements and ledgers were cross-checked verbally by the clerks and the ‘jiggers’ or bookmarks marking the entries in the ledgers put away. Deposit Account entries were made in the customers’ pass books, which they brought in with them. One very old lady kept a houseful of cats and hers carried a distinctive and very strong fishy smell. Her book was consequently always made up at breakneck speed as the clerk entering the transaction had to hold her breath while doing so.

Bank opening hours at this time were from ten o’clock in the morning until three in the afternoon and from ten until twelve on Saturday mornings, when a smaller number of staff were required. During the week they ‘signed in’ at 9 a.m. and worked, with a one hour staggered lunch break, until the day’s work was finished. If the books did not balance, even by a penny, everyone stayed until the error was found and all the tills and entries were correct. The listings were checked by one member of staff reading out the amount in words written on each cheque, to another ticking off the figures on the list – a time-consuming exercise. If a till was wrong, another cashier would have to count all the cash and go through all the transactions for that day.

At half-year balance times this could entail many hours of overtime while figures were cross-checked again and again until the offending item came to light, and woe betide anyone who had missed it earlier.

The ledger clerks took turns in arriving at half-past eight, after collecting the large envelope of remittance cheques, or ‘rems’, from the Post Office in College Street. These had been sent by the individual bank clearing houses in London in separate bundles and each one was listed by the girl on ‘early turn’ on a mechanical adding machine. In order to print each amount a handle on the side of the machine had to be pulled sharply downwards so that it would print out onto a roll of paper at the back. The cheques were then examined and initialled by one of the senior staff before being sorted into alphabetical order ready for ‘posting’ in the ledgers. Local cheques were exchanged by a clerk from each of the town’s banks at the Midland Bank on the corner of College Street/High Street at ten o’clock every morning. Although business cheques carried the company’s name the private cheques carried no identity, so it was essential for every member of staff to know all the customers’ signatures and the terms of their mandates, and the relatively small number of accounts held at that time made this possible.

Perhaps one of the greatest differences between the way things were done then and now was the general attitude towards health and safety. As mentioned before, the cashiers were only a couple of feet away from their customers with only the counter between them. Company secretaries arrived with and collected large amounts of cash, very often at exactly the same time and day every week, mostly alone or with only one colleague as protection, and never with security guards. Until a new branch office was built there in the early 1960’s, the Higham Ferrers branch of the bank consisted of two cashiers and their cash travelling by car on two mornings a week to serve their customers in Mrs Oberman’s front room! Inside the bank, staff facilities were just as basic. The coffee and tea were made downstairs in the basement, very near where the dustbins were stored. It was consumed in a small windowless concrete room containing a few wooden chairs and lined with shelves of old cheques covered in dust, and the washing up was done in the ladies’ wash room. When a parcel had to go by registered post it was tied up with string and the knots secured by dripping hot sealing-wax onto them, melted by the naked flame from a gas pipe sticking out of the office wall. Fortunately, despite all this, no-one was robbed, no-one went down with food poisoning and no-one was burned or set fire to the building.

A description of the National Provincial Bank ’B.C.’ would not be complete without a small tribute to its dedicated and sometimes eccentric members of staff. One of the terms of employment for the Manager must have been that he should play golf, as he always took over the position of Treasurer for Rushden and District Golf Club on his appointment to the branch. His was a much more ‘hands on’ relationship with the customers than is usual today and when the half-yearly charges had to be calculated for those in credit, he would flick through the ledgers imposing what he considered an appropriate figure for each account, usually 2/6d or 5/-, sometimes as much as 7/6d. At Christmas he received sundry gifts from the public and sometimes shared them with the staff. One year they were all given a large cigar each – including the girls!

The Accountant had the unusual distinction of having been in the same branch for twenty years, almost unheard of at a time when male members of staff were moved every five or seven years. Perhaps he had offended the ‘powers that be’ by turning down a posting, and in doing so lost any chance of becoming a Manager, a harsh decision considering that when he was a youth in the early 1920’s or before, his father had had to pay the bank to take his son on as a trainee clerk. Quite a few of the male staff at this time were northerners, a happy and cheerful crowd, but as the bank transferred its staff to wherever in the country a vacancy occurred, the rest came from various cities and towns across the Midlands and southern England. The junior clerks, who earned less than the girls until they were twenty-five years old, were found lodgings in the town with elderly widows who mothered them, but the married men usually bought a local property with the help of a low interest mortgage. The suave, well-spoken senior clerk from Essex had been dropped into France in a glider on D-Day, probably the reason for him being a heavy smoker. Like most of the men, as soon as the doors shut at three o’clock, he would light up his cigarette and start to drop ash down his immaculate waistcoat. (They were allowed to remove their jackets outside opening hours). The air would slowly become more and more smoke-filled, especially on the days when overtime was worked, but nobody seemed to mind. On the whole the staff worked quietly and efficiently together, with few disagreements or raised voices and only the odd good humoured swearword amid the friendly banter. The atmosphere of discipline and mutual respect created a surprisingly relaxed and pleasant environment for the dozen or so workers. Some formed friendships and met after work to socialise, play tennis or baby-sit for one another. One couple met and eventually married while working there and many of the girls kept in touch for years after leaving the bank.

The young men studied for their banking exams, in time started to earn a good salary, moved up the ladder with each new appointment and hopefully became bank managers with branches of their own. The girls stayed for a few years until they married and left to bring up families, very few making it a lifelong career. But with the coming of the computer came other changes. Most of the imposing banking halls have disappeared, male counter clerks are rarely seen and nowadays the Manager may well be a woman. Part-time working mothers ‘man’ the tills and the customers are very often known by their account number, rather than by their face, to the workers behind the scenes. Nonetheless, the personal service given to each of them by their bank remains as mutually important now as it was in the beginning.

Computers have brought banking to the masses and in doing so have helped to bring about a more equal and classless society. The polished wood and dignified atmosphere of the old banking halls have given way to more informal plastic and chrome offices, cash machines and telephone banking, but this new streamlined and automated version continues to give a vital financial commitment to the public and the country. The National Provincial Bank (now the NatWest Bank and part of the RBS Group) still stands proudly in Rushden High Street, an imposing monument to a hundred and twenty years of service to the local community.

|