|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

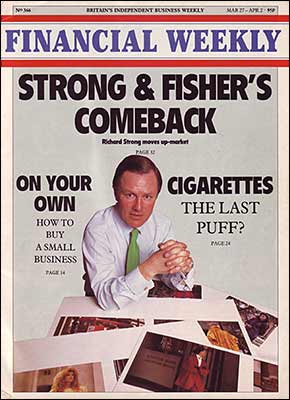

| From the Finacial Weekly 27th March 1986, by Michael Neill |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Strong & Fisher Holdings PLC - Company Profile

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| AS YOU speed through the rolling hills over the next few months, particularly in the West Country or Welsh Borders, those cuddly little lambs you see frolicking in the green fields aren't just going to end up on your dinner plate. Courtesy of Strong & Fisher, they are also earmarked for you or your partner's back as high fashion leather items. Based in the heart of Northamptonshire's traditional shoe leather tanning towns, Strong & Fisher has weathered a deep depression in the world's leather industry to become arguably the top supplier of high quality lamb skins paraded on the catwalks by many of the leading fashion houses in North America and Europe. Indeed, reversing the trend which decimated the European leather industry in the late seventies and early eighties, Strong & Fisher has just landed its first large scale contract with Japan. At the core of Strong & Fisher's recovery from disaster is a new flow in the world's leather trade. Strong sells to the predominantly anonymous 'makers-up' who supply garments of specific design to the world's fashion houses. By the late seventies, western aid to the Third World enabled many countries in the Far East, particularly India and South Korea, to take their lamb skins or cattle hides right through to manufactured items. And because these new indigenous industries operated with 'sweated' labour, cheap foreign goods flooded western markets and devastated domestic industry in Europe and North America.

In 1979, Strong & Fisher made pre-tax profits of just over £2.1m on a turnover of roughly £42m. The next year, turnover fell by approximately £3.5m, and the company plunged into the red with a massive £2.4m loss in profits. Progress through the next two years was slow, and even in 1983, when Strong & Fisher returned to the black with pre-tax profits of £413,000, turnover was still down by just over £3m compared with 1979. But over the last two years the company has gone from strength to strength. Turnover last year was a blistering £57.6m, with pre-tax profits up 53% at £4.24m. And on the basis of last week's interims showing pre-tax profits up by 8% at £2.1m, remembering the second half is always stronger than the first, Strong & Fisher is on course to fulfil brokers' hopes of year-end profits of £5.2m. With the lean years now well behind it, Strong & Fisher today supplies high quality skins to those very same Far Eastern makers-up whose cheap leather garments flooded western markets in the early eighties. This new flow of trade grew primarily out of a fundamental shift up-market in western consumer demand, although sterling's return to a more realistic level played its part. But Strong & Fisher deserves credit for grasping the opportunity by diversifying its product and moving up-market with the western, and now the world consumer. Historically, Strong & Fisher was a one-product company - "the king of suede" is how managing director Richard Strong puts it. This is fine when suede is in fashion, but disastrous when it is not. The need for a fundamental transformation of the company's business was abundantly clear by 1981, but the breakthrough didn't come until late the following year. Admirably frank, Strong laments he: "Didn't react quickly enough to market forces. We should have cutback in 1981, instead we cutback in 1982. This is the main mistake I'd criticise myself for as a manager." Biblical rhythm More importantly, Strong & Fisher just didn't have the new products on-line. The breakthrough here occurred in 1982 when "in-house brainpower" came up with a closely guarded method of tanning thinner skins which had their natural imperfections, such as wrinkles at the neck, rolled out. This proved crucial for the company's break-out into the wider high-fashion market which uses leather not merely in jackets, but as a fabric in dresses, blouses, shirts etc. Strong & Fisher is extremely lucky with its workforce. Many of the technical managers have been with the company all their working lives, and traditional skills acquired over generations in the leather trade are crucial on the shop-floor where work involves the skilled grading and handling of skins over sueding, cutting or embossing machinery in what is essentially a low-tech industry. And the point is not lost on senior management. Strong & Fisher operates an employee share scheme, and over the past two years has set aside £220,000 from profits to provide shares for every person who has been with the firm at least three years. Not that Richard Strong is over-sentimental about long serving staff. He readily admits that one advantage of the lean years was a management shake-out which, by death or promotion, saw younger, more profit-conscious managers take up the reins. "Profit-consciousness is where the shake-out really transformed us. The attitude now is how can we make more money, instead of I've done very nicely, I've hit budget this week." Overall control

With its skins being shipped all over the world, Strong & Fisher could easily fall foul of volatile or irrational exchange rate movements (as it did in the early eighties). So the company now hedges its currency exposures, which can include the European Currency Unit, through its main bank National Westminster. The reason for all this is the new products rolled on to the high fashion market in November 1982. Strong said: "The new range of thin, soft leathers in new colours were sampled massively and received enthusiastically. They formed the base for turning the business back to profit because we got very good orders in early 1983 for the autumn which, in financial terms, was when the world was awakening and we were there with the right products." |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Innovation

A second level of innovation came last year, when Strong & Fisher contracted a North London textile printer to finish its new range of suede and printed leather. This enhanced further Strong & Fisher leathers' role as a fashion fabric, and with the order intake for spring 1986 already reaching a healthy level, profits from the tanning division are set for another record year. The key to all this, apart from a worldwide boom in demand for leather garments, is internal market differentiation coupled with a wide geographical spread of markets. Both, the company believes, shield it from the leather industry's traditional cycle of boom and bust. First, by moving up-market to supply high fashion, Strong & Fisher is tapping a consumer market which is impervious to dips in spending in periods of economic depression. But having captured the market, the company has to remain on its toes, liaising closely with its foreign sales agents to ensure a quick response to fickle fashion. Second, by casting a wide geographical net Strong & Fisher is spreading the risk from any fundamental downturn in the leather market since there are time-lags between what is 'it' in London and Paris, or New York, Toronto and Tokyo. Futhermore, the whole thrust of the company's development is to lift leather out of its traditional fashion role. And by producing new, thin, soft, printed or textured lines of various hues, it can turn leather into merely another fabric which a fashion house will want to use throughout its collections. So confident is Richard Strong that this policy has broken the traditional cycle, Strong & Fisher is re-directing its wider Turkish operation away from meat distribution towards a greater concentration on skin trading. Not that Strong is going to pull out of meat distribution. Strong & Fisher's Middle East division, primarily through the 100% subsidiary Middle East Meat Industries Ltd started trading in May 1985. This company is involved in marketing chilled meat from Turkish lambs into the Islamic Middle East. Religion aside, there is a growing demand for this meat in the oil based Arab countries which have enjoyed a dramatic increase in standards of living. To date, the main efforts have been devoted to bulk sampling and developing the infrastructure needed to ensure consistently high quality standards as well as the technical competence to manage regular road and air freight deliveries. Consequently, there was an extraordinary item of £259,000 last year relating to the cost expended so far on this investment. But there is an almost complete lack of local expertise in supplying large volumes of chilled meats on a regular basis and with assured quality. This presents an excellent opportunity for the special skills MEMI can utilise, including its 40% stake in a privately-owned abattoir at Eregli in the main lamb growing area of western Anatolya. Pre-tanning Climate is a great advantage, giving the raw, salted lamb skins a pre-tanning life of up to nine months. "This new trading division will become the main profit-centre in the Middle East," said Strong, "we'll be supplying Turkish tanners only, not taking the skins for our use in the UK. Middle East skins are excellent for Turkish requirements, but not for Strong & Fisher." This emphasis on quality runs right through the company's operations, from finished product to original raw material - lamb skins from UK abattoirs and from fellmongers in New Zealand. The antipodes come in to secure an all-year-round supply of 'pickled' pelts for Strong & Fisher's tannery division in the UK. Throughout the UK the company has 11 hide and skin collectors, wholly-owned subsidiaries which bid on a weekly basis to clear abattoirs of cattle hides, lamb and sheep skins and offal on a daily basis. As soon as this raw material enters Strong & Fisher's various fellmongery plants, by-products arise for sale either to different industries, for example grease for cosmetics, or to other leather manufacturers. At the moment, Strong & Fisher's woolskin tanneries are going through an export revival, and production should return to full capacity within the year following a £200,000 investment in plant and machinery. The difference between Strong & Fisher and the rest of the UK leather industry is that it rejects the skins others accept. And it is clear the money isn't so much in the hills, as bouncing on top of them waiting to be slaughtered. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||